Unlocking Financial Potential: A Guide to Fintech App Development

Content Map

More chaptersThe financial technology industry has risen significantly in the last few years and expects to continue with a revenue growth of 17.38% in 2025. Digital change continues to redefine the traditional banking paradigm, and with this change, startups are emerging to offer new digital solutions in banking and payments, investments, credit, and more.

One of the primary reasons behind fintech industry growth is the fintech mobile app development. New statistics revealed that currently 80% of consumers employ fintech applications for everyday financial operations. In addition, the active time spent within finance apps by the users who are below 35 years old is 4 hours a week.

For the entrepreneurs and developers, such unique fintech software is one of the most profitable endeavors. But this comes with several factors that entail the understanding of business and technical contexts. This guide gives designers of fintech app development a roadmap on how to develop these applications with outstanding user experiences, while also meeting the toughest levels of security that are expected in the industry.

What Is Fintech?

Fintech is an abbreviation for financial technology, whereby advanced technology is used to enhance and make traditional financial services more efficient. It is the implementation of complex approaches to improve an organization’s performance, accessibility, and client satisfaction in the financial industry.

The use of technology in offering financial services has rapidly adopted itself over the last few years due to the presence of smartphones, cloud computing, and artificial intelligence. Thanks to such novelties, one can create different fintech applications, from mobile payment applications to algorithmized trading platforms.

Therefore, there is a solid growth of the global fintech market with numerous entering startups and incumbent companies. Such growth has been realized because of the higher consumer desire for efficient, flexible, and bespoke genuine services such as financial services. Fintech seems to be invading the activities traditionally performed by traditional financial institutions because it can provide better, cheaper, and different solutions to manage money.

Moving from simple personal finance app tracking through money spending to more complex budgeting apps, fintech changed the manner in which people interact with money. Furthermore, it has also brought effectiveness in the management of the financial aspects of any company, eliminating the incidences of exaggerated charges from traditional banking institutions.

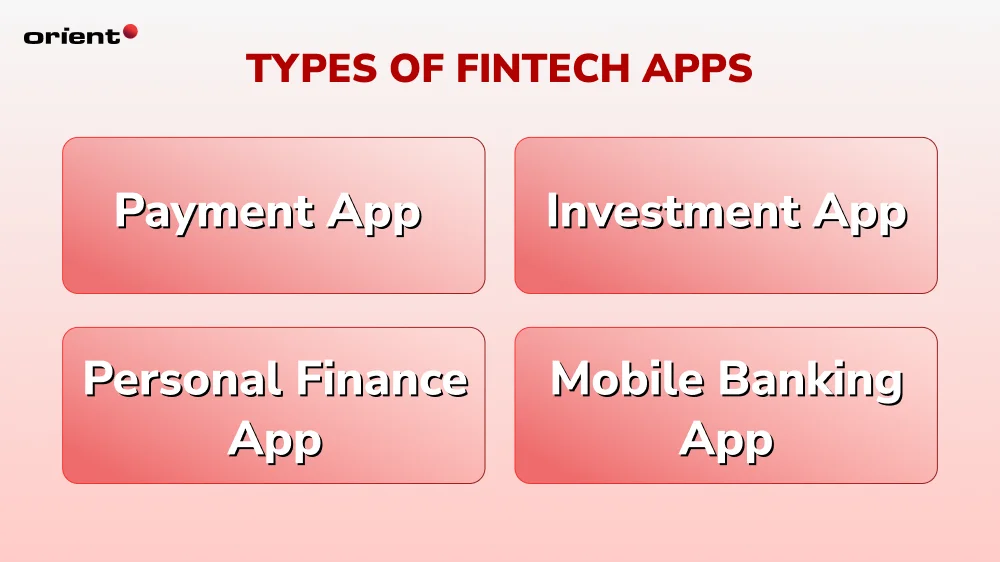

Types of Fintech Apps

Depending on their basic functions and features, fintech mobile apps may be divided into several groups according to a task perspective. This categorization is useful for gaining a view of the wide range of fintech solutions and where they can be applied in the financial sector.

Payment App

Payment apps are commonly created to enable people and companies to transact easily and safely. Such apps have brought a drastic change in how people deal with money by making mobile payments quick and convenient. For example, PayPal and Venmo enable users to transfer money between individuals without hassle. They are part of the digital economy, allowing clients to pay each other, online shopping, or transfer money across borders.

Investment App

Investment apps give their users the ability to manage and build their investments. These apps are versatile for both inexperienced and experienced investors due to their functionalities of trading in stocks, portfolios, and advisory services. Some famous examples include Robinhood, which is a brokerage app that doesn’t charge commission, and Acorns, through which people can invest their spare change. These apps help to popularize investing and go beyond the circle of people who are informed about stock trading.

Personal Finance App

Apps for personal finance enable people to monitor their financial situation and create financial plans in the form of on-budget expenses and financial goals. Mint and You Need A Budget (YNAB) are such examples, as they allow the user to get acquainted with people’s spending behavior and become financially secure. They are very useful tools that propose recommendations and continuous updates regarding financial operations.

Mobile Banking App

Mobile banking app development is done by conventional banks and fintech companies to deliver banking solutions on user’s mobile devices. Some of the services include account management, money transfers, bill payments, and loan requests across the country. Such apps include the ones developed by leading banks, such as the Chase Mobile application, as well as fintech startups like Revolut. They improve customers’ willingness and accessibility in that they are able to conduct banking activities at their own convenience.

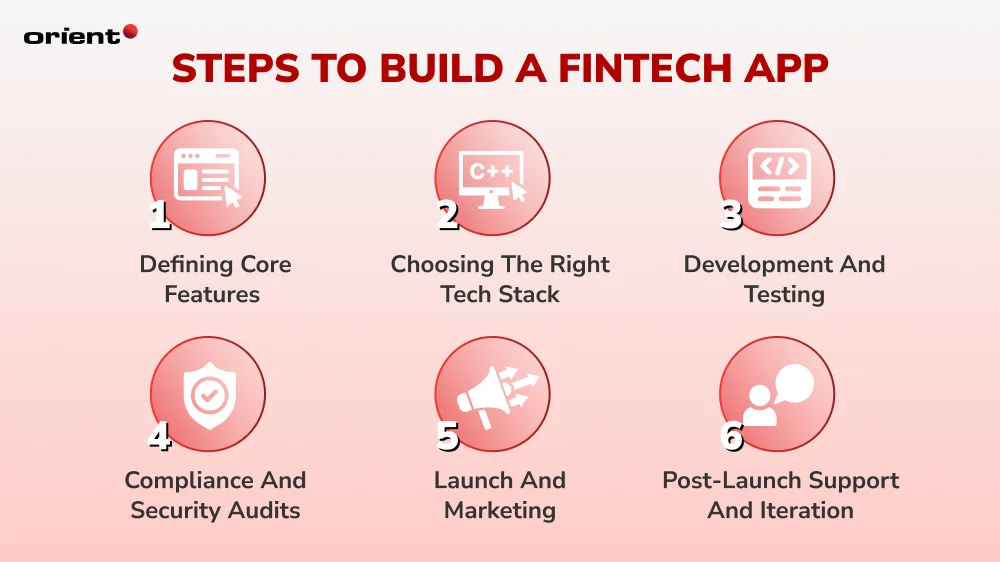

Steps to Build a Fintech App

Creating a successful fintech app is a complex procedure represented by multiple phases and stages, which require a strong technical background, as well as deep knowledge of user requirements. Every phase of the process is important to consider, from brainstorming for the app idea to the final stages of launch, in order to consider regulatory issues and achieve the best interface for the app. The following is the complete fintech app development process with core features and recommended technologies.

Defining Core Features

Once you have a general idea, you should identify key features based on which you will create your fintech app. These features will lay the foundation of your application and thus be able to meet the required standards by the users and regulations. Here are some key features to consider:

- User Authentication and Security: Ensure strict security devices like login through several try methods, fingerprint and face recognition, as well as encryption of the crucial user information.

- User-Friendly Interface: Develop an easy-to-use layout that does not confuse or complicate the run-time user experience. If the UI is well-designed, it can go a long way toward increasing usage rates and user satisfaction.

- Real-Time Data Processing: Make sure your app gives the users an option to track their transactions, their balances, and changes in the market in real-time. This feature is very essential for investment and trading applications.

- Payment Integration: Include safe payment systems that affect the transactions. A user should be able to make payments via credit/debit cards, wallet, and bank transfers.

- Financial Management Tools: Such tools include budgeting, expense tracking in payment methods, and other financial analytical tools. The additional features that can help enhance the application’s utility are the specific tools for managing personal finances.

- Compliance Features: Make sure your application adheres to guidelines regarding financial compliance, specifically Know Your Customer (KYC) and Anti-Money Laundering (AML). This entails putting in place measures for identifying an individual and monitoring the transactions.

- Customer Support: Include an office-based customer care service that will be available through the application, either through a chatbot or live chat. The availability of help ensures that people remain on the website more, thus increasing their level of comfort and ability to remain with the services offered.

Choosing the Right Tech Stack

Selecting the appropriate technology stack is vital for the app’s performance, scalability, and security. Here are recommendations for popular programming languages, frameworks, and databases commonly used in fintech development:

Programming Languages

- Java: Highly regarded for its scalability and security, Java is often used for building back-end systems in fintech applications.

- Python: Known for its simplicity and flexibility, Python is ideal for developing algorithms and handling data analysis. It’s commonly used in machine learning applications in fintech.

- JavaScript: Essential for front-end development, JavaScript frameworks like React or Angular allow for creating dynamic and responsive user interfaces. Node.js enables JavaScript to be used on the server side as well.

Frameworks

- Django (Python): A high-level web framework that emphasizes rapid development and clean design, making it suitable for fintech applications requiring strong security features.

- Spring Boot (Java): This framework simplifies the development of enterprise-level applications, providing built-in support for security and data management.

- Angular/React (JavaScript): These frameworks help in building interactive user interfaces, improving user engagement and satisfaction.

Databases

- PostgreSQL: An open-source relational database known for its robustness and support for advanced data types, making it suitable for complex queries and transactions.

- MongoDB: A NoSQL database that allows for flexible data modeling, ideal for applications that handle unstructured data or require rapid scaling.

- MySQL: A widely used relational database management system that is reliable and easy to configure, making it a common choice for many fintech applications.

Development and Testing

With the tech stack in place, the development phase begins. This process typically involves both front-end and back-end development. It’s crucial to adopt an agile development methodology, enabling for iterative improvements based on user feedback. Regular testing is important to detect and fix bugs early in the development process. Conduct unit tests, integration tests, and user acceptance testing to ensure the application functions as intended and meets user expectations.

Compliance and Security Audits

Before launching, ensure that your app complies with all relevant financial regulations and undergoes thorough security audits. Validate adherence to data protection laws such as GDPR and PCI-DSS. Engaging with legal and compliance experts can help you navigate the complex regulatory landscape and ensure your app is fully compliant.

Launch and Marketing

Once your app is fully developed and tested, it’s time to launch. Choose an appropriate platform (iOS, Android, or web) and prepare for deployment. Develop a marketing strategy to promote your app, utilizing social media, content marketing, and targeted advertising to reach your audience. Consider incentivizing early users with promotions or referral bonuses to drive initial engagement.

Post-Launch Support and Iteration

After launch, continue to monitor user feedback and app performance. Providing ongoing support is crucial for user satisfaction and retention. Use analytics tools to track user behavior and identify areas for improvement. Iteratively update your app based on user feedback and emerging market trends to keep it relevant and competitive.

Cost of Fintech Application Development

The cost of developing a fintech app can vary significantly based on multiple factors. Below, we explore the average costs associated with fintech application development under different conditions.

Complexity of the App

The complexity of your fintech app is one of the primary determinants of development costs. Apps can typically be categorized into three levels of complexity:

- Basic Apps: These apps offer fundamental functionalities such as user authentication, simple payment processing, and basic financial tracking. A basic financial app may cost between $30,000 and $50,000 to develop. This range usually covers essential features and a straightforward user interface.

- Moderate Complexity Apps: These apps include more advanced features such as real-time data processing, multiple payment integrations, and enhanced security measures like two-factor authentication. Development costs for moderately complex apps generally range from $50,000 to $150,000. This category may also include basic financial management tools and user-friendly interfaces.

- Highly Complex Apps: Apps that require sophisticated features such as AI-driven analytics, extensive integration with third-party services, advanced security protocols, and comprehensive regulatory compliance can be significantly more expensive. The cost for highly complex fintech apps often starts at $150,000 and can exceed $500,000 or more, depending on the scope and scale of the project.

Features and Functionality

The specific features included in your app will directly influence development costs. Some common features and their estimated costs include:

- User Authentication: Basic authentication can cost around $5,000 while implementing advanced security features like biometric authentication may increase costs to $15,000.

- Payment Integration: Integrating popular payment gateways (like PayPal or Stripe) can range from $10,000 to $30,000, depending on the complexity and number of payment methods supported.

- Data Analytics Tools: Building analytics features that allow users to track their finances can cost between $10,000 and $20,000, especially if you require custom reporting and visualization tools.

- Compliance Features: Ensuring that your app meets legal and regulatory requirements can add significant costs, potentially ranging from $15,000 to $50,000, depending on the jurisdictions involved and the complexity of the compliance measures.

Platforms and Technology Stack

The choice of platforms (iOS, Android, or web) and the technology stack will also impact costs. Developing a native app for both iOS and Android typically requires more resources and time compared to a single-platform app. Here’s a breakdown:

- Single Platform (iOS or Android): The cost for a single platform app usually ranges from $50,000 to $150,000.

- Cross-Platform Development: Using frameworks like React Native or Flutter can reduce costs, with estimates ranging from $40,000 to $120,000. Cross-platform apps allow you to reach a wider audience without duplicating development efforts.

- Web Applications: Developing a web-based fintech application can range from $30,000 to $100,000, depending on the complexity and required features.

Maintenance and Ongoing Costs

After launching your fintech app, ongoing maintenance and updates will incur additional costs. Typically, you can expect to allocate around 15% to 20% of the initial development cost annually for maintenance, which covers updates, bug fixes, and new feature implementations. Regular updates are essential to keep the app compliant with regulatory changes and to maintain security standards.

Final Suggestion

The fintech app landscape is diverse, with each category addressing specific needs within the financial industry. A fintech app development company plays a crucial role in creating these innovative solutions, driving the digital transformation of financial services.

To navigate this complex fintech app development journey, consider partnering with Orient Software. Our team of expert web and mobile application developers is well-versed in the latest technologies and industry best practices, ready to support you in building professional fintech apps tailored to your unique requirements. With a focus on user experience, security, and scalability, we can help you transform your ideas into robust applications that meet the demands of today’s consumers. Let us work together to create innovative fintech solutions that not only enhance financial services but also deliver exceptional value to your users.