From Start to Finish: How to Build a Fintech App with 6 Proven Steps

Content Map

More chaptersThe rapid development of digital transformation combined with the latest technology trends has created a new revolution in the financial industry. From online payment shopping on e-commerce platforms to sending money internationally by using banking apps, it can be said the target audience uses fintech solutions almost every day.

According to statistics from a financial group called Robocash, the Vietnamese fintech market is growing at the second-fastest rate in the region, with Singapore leading, and is expected to reach US$18 billion by 2024. Despite intense competition, the fintech industry is still a promising sector worth investment and budget because of its existing customer base and the various benefits it brings to businesses.

If you cherish an innovative financial app idea and are ready to make it happen, this article will provide you with a complete guide on how to build a fintech app.

Typical Types of Fintech Solutions

Fintech has opened many new gates for the financial sector. By integrating a wide range of modern technologies into complex financial solutions, such as budgeting apps or the combination of data science in fintech, fintech mobile app development is not limited to just a few fields and services as before.

Nowadays, more and more modern applications are appearing to enhance traditional financial systems and promptly meet customers’ growing needs. Here are some typical types of fintech mobile apps.

- Digital Banking Apps: A mobile banking app plays the exact same role as a traditional bank branch by providing most services, such as opening accounts, transferring funds, managing payments, and accessing customer support.

- Investment Apps (WealthTech): Investment platforms offer digital wealth management solutions and investment advice using artificial intelligence (AI) to financial advisors and individuals with needs in portfolio management, investment research, risk assessment, and retirement planning, eliminating intermediaries.

- Peer-to-Peer Lending Apps: Digital lending apps are a direct link between borrowers and lenders, helping them streamline the loan application process, provide alternative lending options, and offer competitive interest rates without relying on traditional financial institutions.

- Personal Finance Apps: A personal finance app helps individuals manage their overall financial health effectively by providing features and tools, including budgeting tools, expense tracking features, financial goal setting, insights into spending habits, etc.

- Insurance Apps (Insurtech): Insurance apps transform traditional insurance processes by using data analytics to offer digital insurance products, streamlined claims processes, personalized policy recommendations, and advanced risk assessment.

- Regtech: Regtech apps use innovative technologies to help financial companies comply with regulatory policies, which include identity verification, anti-money laundering (AML) solutions, risk management systems, and automated reporting tools.

Fintech App Development Process: How to Build Fintech Apps from Scratch

A successful fintech app starts with investment and careful attention to the development process. As the process of creating fintech apps is not a matter of one day, more than anyone else, businesses need to start from the smallest things and clearly understand their own needs. What are the specific steps to complete a fintech application? The detailed instructions below may enlighten you.

Step 1 - Determine the Type of Fintech App

Obviously, you already have your fintech idea in mind. However, before rushing to implement it into reality, don’t forget to participate in some important initial steps to create a solid foundation for the later development phase.

Start the fintech development process by identifying the specific area or niche within the fintech market that your app will target. Although it is only the first step in such a process, it profoundly affects the structure of your fintech app development team, the target customer group, and the technologies used.

Will it be an investment app or a lending app? It is worth noting that while popular niches may face more intense competition compared to unpopular ones, they own large user bases available. In contrast, less well-known or newer fintech niches have the disadvantage of limited resources, less visibility, and the challenge of breaking through in a competitive landscape but offering a lower level of same-segment competition. Wisely consider before taking the next steps.

Step 2 - Conduct Market Research

The scope of the market survey has been narrowed as your business determines the type of fintech app you want to implement. By focusing on conducting market research only on a specific niche, companies optimize resource allocation and gain a deeper understanding of relevant aspects.

The market survey process does not simply stop at analyzing user needs (e.g., demographics, behavior patterns, financial goals) and competition analysis (e.g., strengths, weaknesses, features, pricing models). It requires staying up to date with the latest trends in the fintech industry and identifying customer pain points where there is room for improvement.

Step 3 - Define Your App’s Key Features

Based on the market research results in the step above, make a list of core features and functionality your app will offer and prioritize them based on their importance and feasibility. Regardless of the chosen type of fintech app, a typical one may include features such as account management, transaction tracking, analytics, payment integration, etc.

Of course, you can consider adding some advanced features to differentiate your own app from competitors. However, it is advised not to stuff your app with too many features. Instead, focusing on the features that make your fintech app cost-effective and faster brings much more value.

Step 4 - Ensure Regulatory Compliance

As it revolves around financial-related services, fintech apps require high security. Regulatory compliance on different types of financial technology solutions does not simply revolve around complying and publishing an app based on app stores’ guidelines; it has strict requirements on data protection or anti-fraud standards.

Typically, fintech apps need to comply with regulatory requirements called DPA (Data Processing Agreement) under GDPR whenever handling users’ personal and financial data. Some countries even have separate policies for fintech app development companies intending to release apps in their region.

Depending on the target niche, businesses need to conduct compliance research to ensure compliance standards. This process may generate additional penetration testing and quality assurance practices, which are helpful in identifying potential legal hurdles and restrictions that need to be adjusted.

Step 5 - Define the Monetization Model

A well-defined monetization model plays an important role in generating revenue for the fintech apps. This step requires the business to fully outline how the app generates income. Does your application generate profit through user fees, transaction fees, or partnerships and advertising?

By implementing an effective monetization strategy, companies secure the revenue of the fintech apps and use them to cover operational costs, invest in further development, and achieve ROI software. In short, this is a sustainable financial foundation for the app that every business owner needs to pay attention to.

Step 6 - Develop and Launch the App

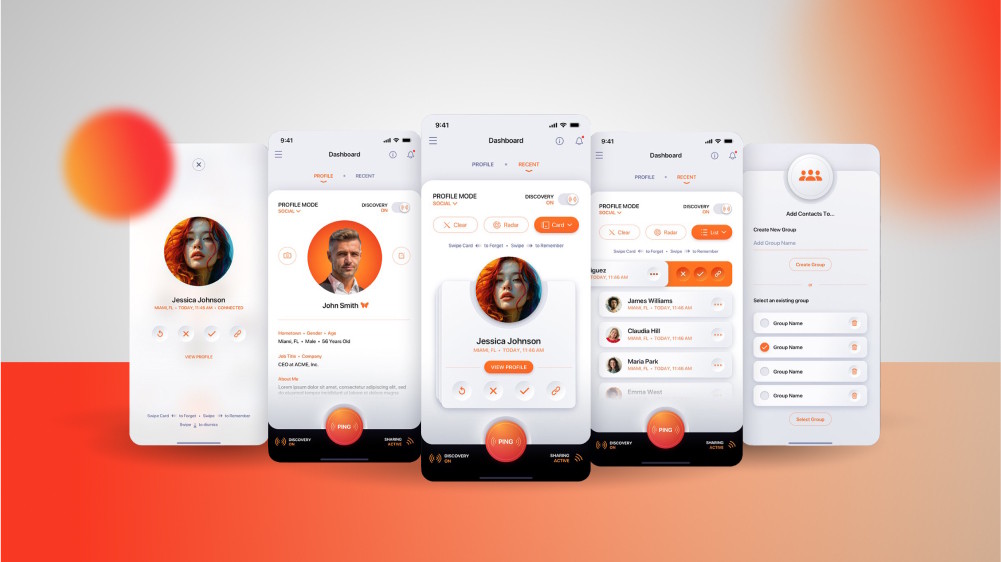

All preparations are ready. After assembling a development team that has a proven track record in the industry, it is time to get involved in the development phase. By following industry best practices and leveraging modern financial technology, dedicated developers performed technical implementation and construction of the app, resulting in a user-friendly and functional fintech application.

This stage commonly includes the below key steps:

- Backend Development: This step focuses on building the server-side logic and infrastructure that powers the application, which may include setting up databases, APIs, security measures, and integrating with third-party services.

- Frontend Development: This step involves designing the UX and UI of the fintech apps, such as implementing screens, navigation, and other interactive elements.

- Testing and Quality Assurance: This step requires testers and quality assurance specialists to conduct functional testing, performance testing, security testing, and usability testing, ensuring the app functions as intended.

- Deployment and Launch: This step revolves around deploying the app into the production environment through setting up hosting infrastructure, configuring deployment pipelines, and ensuring scalability and reliability. The fintech app is ready to launch if no errors arise.

Challenges in Creating Fintech Applications

It is undeniable developing fintech apps brings businesses tons of benefits. However, such processes also pose potential challenges that developers and companies need to address.

Security and Fraud Prevention

All fintech apps have the noble responsibility of dealing with large volumes of sensitive financial and personal data, making security a top concern. This information is lucrative prey for hackers who want to exploit it for improper purposes.

Letting cyberattacks occur not only affects a brand’s reputation but also potentially exposes them to violations related to financial regulations and data privacy laws. Thanks to the help from robust fintech app security solutions, fintech apps in modern times mostly have higher levels of security, protecting user information from unauthorized access, data collected, and fraudulent activities.

Continuous Innovation and Competitive Differentiation

As a developing industry, fintech has a high level of competition, with new technologies and players emerging constantly. Developing a fintech application nowadays is not simply a matter of creating a functional solution since it requires much more than that.

In order to attract users and turn them into loyal customers of an app, businesses must have solutions to continuously innovate and differentiate compared to common market standards. Providing a fintech app that is both useful and unique is key to remaining competitive.

User Trust and Adoption

It is not easy for customers to give up a favorite fintech application and switch to using a new one. As fintech solutions contain a lot of confidential user information and are a channel for financial management, they tend to rely on a popular and familiar product instead of a new alternative.

Launching a new product can be a challenging experience for startups. However, reliability is an element that can be built and cultivated over time. By demonstrating a strong commitment to security, privacy, and transparent communication, a fintech app can gain user trust and drive adoption.

Insider Tips to Develop a Fintech App

In order to speed up the fintech app development process, there are some valuable tips to keep in mind:

- Partner with reliable fintech app development companies to leverage their existing talent pool’s expertise and commit to product outcomes.

- Integrate your fintech app with established financial institutions like banks or investment platforms to offer comprehensive financial services.

- Stay updated with the latest compliance standards to maintain compliance for your fintech app.

- Create an MVP before launching the official version to gather user feedback and make room for improvements.

- Focus on data analytics to gain insights into customer behavior and transaction trends, personalizing user experiences and improving app performance.

- Use pre-built fintech platforms or frameworks to save time and effort used for the development process.

Wrapping Up

Fintech applications are in great demand. Even the world’s leading traditional banks have launched customized mobile apps to leverage internal business processes and connect closely with the target audience. This is the right time for businesses, regardless of size, to take action and mark their names in the fintech market with quality products.

Building a fintech app is a complex process that requires a combination of technical expertise and practical experience in the industry. By following the instructions, applying the tips above, and coordinating with a reliable outsourcing company like Orient Software, your fintech concepts can soon become a reality.