Bank in Your Pocket: A Developer's Guide on How to Create a Money Transfer App

Content Map

More chaptersForget standing in line at the bank or filling out paper checks - the future of money is digital and instant. Money transfer apps have exploded in popularity in recent years, allowing users to securely send and receive funds at the tap of a screen. Whether you want to pay back a friend or split bills, money transfer apps make managing finances faster and more convenient.

With mainstream adoption and innovations like real-time payments on the rise, it’s no surprise that every fintech founder wants to build the next app like Venmo or Apple Pay. As a developer, money transfer software offers huge potential to disrupt traditional banking. However, enabling peer-to-peer transactions on a user-friendly mobile money transfer app interface requires expertly navigating security, speed, regulatory compliance, and more behind the scenes.

This comprehensive guide will walk through the key steps and considerations to build a money transfer application or a peer-to-peer (P2P) payment app from the ground up.

Understanding the Fundamentals of Money Transfer Apps

Money transfer apps allow users to quickly and securely make money transfers electronically, either to individuals or to merchants for payments. By using a linked debit/credit card or bank account, domestic or international money transfers can be executed with just a few taps. Recipients then receive the funds instantly in their local currency through a money transfer system of a mobile wallet or bank deposit.

For users, money transfer services offer convenience over traditional methods like wires. Businesses gain access to a digital payment rail and new customer segments. Recipients in remote or rural areas without bank access also benefit. Consumers turn to these apps to transfer money, pay bills online, split costs, or send funds abroad easily.

The market potential is huge. Cross-border remittances alone are projected to top $750 billion by 2023. Competition is fierce from fintech startups as well as established players like Western Union, PayPal, and money transfer giants expanding into emerging markets. New entrants can carve out space by targeting specific corridors, integration with other platforms, or unique value propositions combining payment processing and financial services.

By understanding user needs, regulations, and the competitive landscape, programmers can craft profitable solutions that make finance more accessible worldwide through the power of smartphone connectivity and money transfer apps.

Steps for Building a Money Transfer App

Building a custom money transfer app requires careful planning, meticulous execution, and adherence to best practices. Money transfer app developers need to follow these crucial steps to create a high-quality app:

Planning Your Money Transfer App Development

In-depth market research is imperative to understand your target demographic, industry trends, and factors driving them to choose one service over others. Surveys and interviews provide user insights to shape the product. Determine the types of money transfer software and which regions or user bases are underserved.

With user personas identified, prioritize essential features. This may include bank/card funding, social login, international transfers, currency exchange, sending and receiving money via mobile number/email, split payments, and invoicing. Consider add-ons like linked savings accounts, credit, micro-insurance, or bill payments. Your Minimum Viable Product (MVP) should satisfy core user workflows.

Create a comprehensive project plan establishing goals, timelines, and team roles. Your initial roadmap may span 6-12 months. Break work into 2-4 week sprints focusing on high-priority features and debug sessions. Establish successes via continual user testing.

Factors like integration complexity, licensing demands, or additional services may expand timelines. Be realistic yet ambitious; have interim usage or retention targets to satisfy investors. Estimate how much it costs to create a custom money transfer app. Continued market validation helps refine future phases.

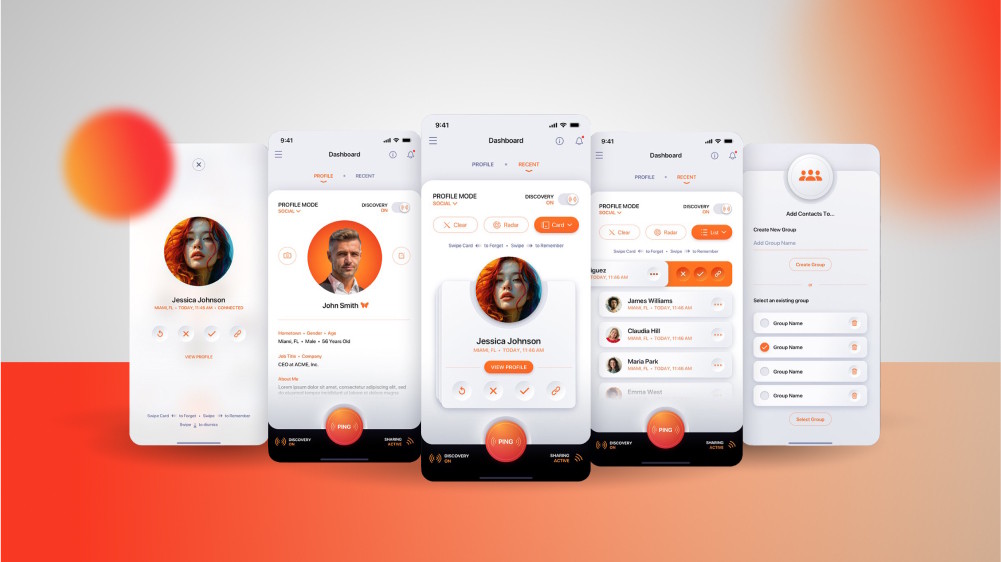

Designing the UX/UI

An intuitive and user-friendly interface is one that is easy to understand and use without requiring much effort or guidance from the users. A user-friendly and intuitive interface can help users achieve their goals quickly and efficiently, as well as avoid errors or frustrations.

To develop a money transfer app that is user-friendly and secure, you need to pay attention to the UX/UI design of your app, as users are dealing with sensitive and personal information, such as their financial data, identity, or security. Users expect a money transfer app to be reliable, trustworthy, and secure, as well as to provide them with clear and accurate information and feedback.

Some of the ways to create an intuitive and user-friendly interface for a money transfer app are:

- Use simple and consistent language and terminology that users can easily understand and relate to.

- Use familiar and recognizable icons, symbols, colors, and fonts that users can easily identify and associate with.

- Use clear and concise labels, instructions, messages, and notifications that users can easily read and follow.

- Use appropriate input methods, such as buttons, sliders, switches, or keyboards that users can easily tap or swipe.

- Use appropriate output methods, such as sounds, vibrations, or animations that users can easily hear or see.

- Use feedback mechanisms, such as progress bars, confirmation screens, or error messages that users can easily monitor or correct.

- Use validation mechanisms, such as passwords, PINs (Personal Identification Numbers), biometrics (such as fingerprints or face recognition), OTPs (One-Time Passwords), email or SMS verification codes, or QR codes (Quick Response Codes) that users can easily enter or scan.

Building a Secure and Reliable Backend

The backend of a money transfer app is the part that handles the logic, data, and communication of the app. It is responsible for processing user requests, storing and retrieving user data, performing transactions, and connecting with other platforms and services. Therefore, building a secure and reliable backend is crucial for ensuring the functionality, performance, and security of a money transfer app.

Some of the key aspects of building a secure and reliable backend for a money transfer app are:

Ensuring Strong Security Procedures to Secure User Data and Transactions

- Use secure communication protocols, such as SSL/TLS or HTTPS, to encrypt the data in transit between the app and the server.

- Use secure storage methods, such as hashing or salting, to encrypt the data at rest in the database.

- Use firewalls, antivirus software, or intrusion detection systems to prevent or detect malicious attacks on the server.

- Use backup and recovery systems to restore the data in case of loss or damage.

Implementing Encryption and Authentication Protocols

- Use passwords, PINs, biometrics, OTPs, email or SMS verification codes, or QR codes to authenticate users and their transactions.

- Use PCI DSS (Payment Card Industry Data Security Standard) compliance to ensure that the app follows the best practices for handling cardholder data.

- Use third-party identity verification services for anti-money laundering (AML) and “Know Your Customer” (KYC) procedures.

Integrating with Secure Payment Gateways and Financial Systems

A money transfer app needs to process and manage payments from different sources and destinations, such as bank accounts, e-wallets, credit cards, or cash. It also needs to comply with various regulations and standards for different countries, currencies, and payment methods. Therefore, it is essential to integrate with secure payment gateways and financial systems that can facilitate and secure the payment process. Some of the popular payment gateways and financial systems include PayPal, Stripe, Plaid, and Yodlee.

Developing the Money Transfer App

Some of the key aspects of developing the money transfer app are:

Choosing the Right Technology Stack and Development Framework

- For frontend development: native technologies like Kotlin for Android or Swift for iOS or cross-platform technologies like React Native or Flutter.

- For backend development: languages like Java or Python; frameworks like Spring Boot or Django; architectures like MVC (Model-View-Controller), MVP (Model-View-Presenter), MVVM (Model-View-ViewModel), or MVI (Model-View-Intent); microservices or serverless architectures; cloud platforms like AWS or Azure.

- For database development: relational databases like MySQL or PostgreSQL or non-relational databases like MongoDB or Firebase.

- For API development: RESTful or GraphQL APIs; tools like Postman or Swagger for API testing and documentation.

Breaking Down the Development Process into Stages

- Discovery stage: This is the initial stage where market and competitor research, client interviews, user personas, user stories, user flows, wireframes, mockups, prototypes, and other relevant data and insights are gathered to define the scope, features, goals, timeline, budget, and resources of the project.

- Development stage: This is the main stage where coding, testing, debugging, integration, deployment, and other technical tasks are performed to implement the functionality and features of the app according to the design specifications and best practices.

- Maintenance stage: This is the final stage where support, updates, enhancements, improvements, optimization, monitoring, analysis, feedback collection, and other ongoing tasks are performed to ensure the quality, security, and reliability of the app in the long run.

Collaborating with a Skilled Development Team and Utilizing Agile Methodologies

Some of the benefits of collaborating with a skilled development team and utilizing agile methodologies for money transfer apps include:

- Higher quality: The team can apply best practices, standards, and guidelines to make sure the quality of the code, design, functionality, and features of the app. The team can also use various tools and methods to test, debug, and fix any issues or errors in the app.

- Faster delivery: The team can work in sprints, which are short periods of time where particular tasks or features are completed and delivered. The team can also use tools like Git or SVN for version control, Gradle or Fastlane for automation, Firebase App Distribution or TestFlight for beta testing, and other tools to speed up the delivery process.

- Better communication: The team can use tools like Slack or Zoom for communication, Jira or Trello for project management, Google Docs or Confluence for documentation, and other tools to facilitate and improve communication among team members, as well as with clients and users.

- Higher satisfaction: The team can use tools like UserVoice or SurveyMonkey for feedback collection, Firebase Analytics or Mixpanel for user behavior and engagement analysis, and other tools to measure and enhance user satisfaction, retention, and loyalty.

Testing and Quality Assurance

Testing and quality assurance are critical for ensuring the reliability and security of money transfer apps. Thorough testing helps identify and rectify any bugs or vulnerabilities before launching the app. It involves comprehensive checks for features, performance, security, and compatibility across different platforms.

Quality assurance processes make sure that the app meets the highest standards, providing a seamless user experience while transferring money. By investing in rigorous testing and quality assurance, you can build trust among users, enhance the app’s credibility, and ensure smooth and secure transactions for your users.

Ensuring Ongoing Maintenance and Updates

Ongoing maintenance and updates are essential for the smooth operation and continuous improvement of money transfer apps. Regular maintenance involves monitoring the app’s performance, addressing any issues or bugs promptly, and ensuring data security. It also includes keeping up with the latest industry standards and regulatory requirements.

Additionally, timely updates are crucial to enhance features, introduce new functionalities, and improve user experience. By prioritizing ongoing maintenance and updates, you can provide a reliable and up-to-date money transfer app, ensuring user satisfaction and staying competitive in the dynamic financial technology landscape.

Final Suggestions

Take the next step towards developing a custom money transfer app that meets your business requirements by collaborating with a skilled development team. Orient Software is your trusted partner for turning your app idea into reality. With a proven track record of delivering innovative and secure software solutions, Orient Software has the expertise and experience to provide custom software development services that align with your specific needs.

Our dedicated team of professionals will work closely with you to understand your goals, provide valuable insights, and ensure the success of your project. Contact Orient Software today and embark on a journey towards a cutting-edge money transfer app that drives your business forward.