Evaluating Top Wealth Management Tools for Savvy Investors

This article reviews some of the highest-ranked wealth management apps targeted at the shrewd investor. Learn about important aspects, consider various price plans, and find out which application will help you achieve your investment objectives and financial dreams.

Content Map

More chaptersDespite a 58% increase from 2020, experts predict that the digital wealth management user base in US will reach 27.5 million in 2025. This rapid adoption of wealth management tools is due to the fact that they can offer the convenience of easy access to investment management and financial planning right through one’s pocket.

As more and more endeavors into digitalization in financial services, the race to create the ultimate wealth management app becomes a contest, much to the advantage of investors. However, which one of them is the most suitable for your individual financial requirements and objectives?

While we have players like Betterment or Empower that offer robotic advice to build and invest portfolios, there are emerging apps that offer many features, like Simplifi or Ziggma. In this ultimate roundup, we will have the contenders try out the different aspects of their apps, compare their strengths and weaknesses, the fees they charge, and the experiences of their users to assist you in choosing the program that will help you lead the life you’ve always imagined.

Why Use a Wealth Management Tool?

The first and most obvious benefit of a wealth management app is the simplicity with which it can be accessed. In essence, within the blink of an eye, and using your smartphone or tablet, you can have a full toolkit that includes the capability to track, monitor, budget, and plan your financial future and current investment. This gives you ease of access to your finances from anywhere at any time so as to help you make decisions whenever you are on the move.

Additionally, those wealth management applications often feature data analysis components and customized user experiences with tips to improve your decision-making. Some of them include tracking your expenditures, tracking your investments, and formulating your long-term financial goals; the apps are thereby able to offer suggestions on how you can effectively manage your resources to build your wealth. Such talents of personalization and a data-driven approach to guidance may be truly valuable in the variable and often intricate world of finance.

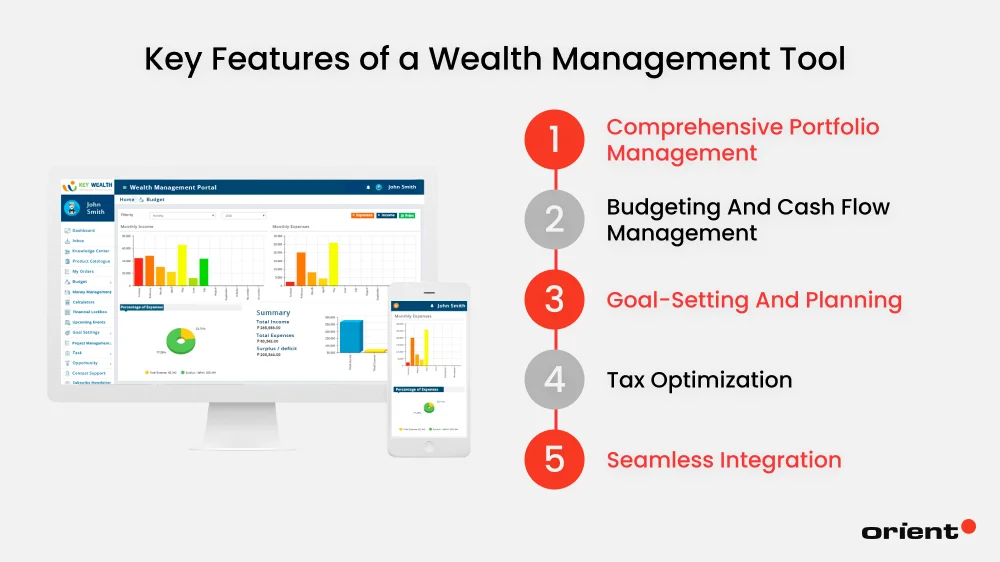

Key Features to Look for in a Wealth Management App

Choosing a wealth management app depends on the number of features that it provides and the level of functionality when it is used for managing your finances. Some key features to look for include:

- Comprehensive portfolio management: A good wealth management app should be able to offer an account summary that contains an overview of your investment and help you keep track of the trades and their performance and help in rebalancing your investment portfolio.

- Budgeting and cash flow management: Another important thing that you should understand is your income, expenditure, and money circulation, which is the basis for further wealth management. Digital money managers should have an easy-to-use interface that provides features for budgeting, tracking expenses, and making bill payments.

- Goal-setting and planning: Elite wealth management tools should assist you in setting goals in terms of how you would like to see your money spent, saved, or invested; for instance, for buying a new house, for retirement, or for children’s college education.

- Tax optimization: Incorporation of tax planning features in your wealth management application can ensure you pay low taxes as you look forward to achieving long-term economic gains.

- Seamless integration: Think of those apps that show a combination of your banks, credit cards, and other finances on a single page or platform.

In these key areas, you are able to make consideration and get the specific wealth management app that can help you to work towards the achievement of your wealth-creating goals.

Top Wealth Management Tools in the Market

Empower: Best Free Investment Management App

Features and Benefits: Empower is an all-inclusive financial services toolkit providing free services such as budgeting, balance sheets, and custom retirement investment portfolios. It also offers self-directed investors for $100,000 or more to invest advanced investment advice. The flagship product of Empower is the Empower Personal Cash account, which has an awesome interest rate of 4.70%. A lot of consideration has been put into the user interface and user experience across both the mobile application and the website.

User Reviews and Ratings: The Empower app has been positively reviewed and has been rated 4.8 out of 5 stars from over 121,000 reviews from the Apple App Store. For owners of Android-based devices, it is available on Google Play with 4.7 out of 5, as stated by more than 105,000 reviews. Customers enjoy the range of financial features available and the fact that they can live to speak with real financial advisors.

Simplifi: Best for Beginning Investors

Features and Benefits: Simplifi is a Quicken product that helps people manage their money. It consolidates all types of accounts, such as savings, checking, credit cards, and loan accounts, into a single entity. Simplifi has the features of sending alert notifications, cash flow forecasts, and analysis of reports so that users can manage their money wisely. It also features customizable budgeting plans, specific savings objectives, and other features that suit newcomers to self-coordinated banking.

User Reviews and Ratings: Simplifi has a mixed reception among users. It has a rating of 4.0 stars from more than 2,100 users on the Apple App Store. Respondents using Android have rated the app at 2.8 out of 5 stars based on more than 1,300 ratings. Its major supporters boast of its full complement of features and pocket-friendliness as opposed to some of the complaints that touch on the app’s functionality and customer service.

Quicken Classic Premier: Best for Experienced Investors

Features and Benefits: Quicken Classic Premier is a powerful personal finance software designed for experienced investors. Some of the unique add-ons provided by this software include the investment tracking, the retirement planning, as well as the management of small businesses. The mobile application can thus generate rich reports, create dynamic budgets, and present real-time innovations to assist in the management of the finances. Quicken Classic Premier also supports multiple financial accounts, making it ideal for those with complex financial portfolios.

User Reviews and Ratings: Quicken Classic Premier has received positive feedback from users, with a rating of 4.2 out of 5 stars on the Apple App Store and 4.0 out of 5 stars on Google Play. Users appreciate the app’s comprehensive features and the ability to manage multiple accounts seamlessly. However, some users have noted that the app can be overwhelming for beginners and may require a learning curve to fully utilize its capabilities.

Ziggma: Best for Active Investors

Features and Benefits: Ziggma is a state-of-the-art solution that was developed to serve as a portfolio management and investment research tool for both novice and seasoned investors. Among Ziggma’s strengths are the highly detailed stock scores that are calculated using quantitative data and the opinions of finance specialists. These scores give an important clue of how the stock is faring in comparison to other stocks, more so in its group. Moreover, Ziggma has a portfolio simulator for premium users only that can indicate how a particular trade affects your investment portfolio. Another area covered by the platform is sustainability, with the Climate Impact benchmarking firms on the basis of their carbon data and trends. The target audience of Ziggma is going to benefit from the reasonable $9.90 per month or $89 per year for the premium account.

User Reviews and Ratings: The reviews and ratings collected from the users of Ziggma are, for the most part, positive. It received a user rating of 4.9 out of 5, stating such benefits as the investing software’s capacity to combine several investment accounts into a single portfolio—SaaSworthy. According to the sentiments of the users, most of them love the Ziggma analytics and the insights they get in their investment. The most favored options by the customers include the analytic value of the stocks and the optimization of their portfolios. In all, the users of Ziggma have testified to its usefulness due to the several facilities it possesses and its simplicity.

Betterment: Best Robo-Advisor Investment App

Features and Benefits: Betterment is an outstanding robo-advisor investment application that provides carefully designed financial planning services with minimal intervention from advisors. The application caters to users with no prior knowledge or experience in investing to be able to use the application to invest. It focuses on features such as investment portfolios for individual clients, automatic realization of portfolios, and tax-loss harvesting. The platform leverages sophisticated mechanical processes to develop and administer investment portfolios for every consumer based on his/her financial needs and tolerances. Betterment also provides a variety of learning materials for its users to learn more about investing and improve their decisions.

User Reviews and Ratings: Online customer reviews and ratings of Betterment are also equally favorable. The app is loved by many customers, which is reflected in the high overall rating that the app has on different reviewing platforms, the convenience, the automation algorithms, and the educational materials that are made available to the clients. Betterment is popular with young people and those who never invested before since its strategy is easy to understand and accessible.

Comparing Key Features

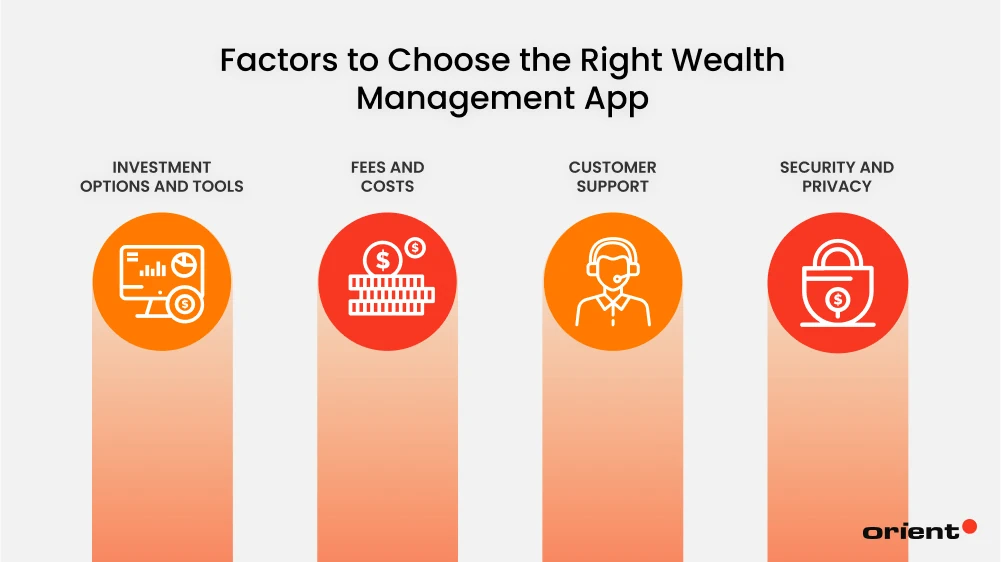

Investment Options and Tools

Empower offers investors full vertical access to purchase different products such as ETFs, common stocks, bonds, REITs, gold, commodities, and private equity. It also offers full discretionary portfolio management for those with $100,000+ in investable assets to get custom investment advice.

Simplifi by Quicken is more about managing money and creating a spending plan than about investing. It helps a user regulate his or her spending, save, and view his or her account balances all in one place.

Quicken Classic Premier has a wealth of investment features such as reporting, tax, and retirement. It deals with all types of investments and gives you great tools for tracking and researching your investment portfolios.

Ziggma offers automated investment solutions mainly focusing on exchange-traded funds and mutual funds. It provides customers with the advanced wealth management and investing solutions according to the goals specified.

Betterment is a specialist in automated investing services, and it provides a wide selection of ETFs and individual stocks. This one offers customized investment portfolios that fit your needs, financial plans, and risk level.

Fees and Costs

Empower requires a minimum of $100,000 for any investment advisory services and charges fees of between 0.49% and 0.89% depending on the account balance. It also has a high-yield cash account bonus with no fees charged on the account.

Simplifi by Quicken comes for a price of $47.88 annually or $3.99 monthly. It has no ads and does not require extra fees for the parts like budget and financial planning tools.

Quicken Classic Premier’s subscription is higher than the cost of Simplifi, which begins at $71.88 for a year. For lots of features, it provides comprehensive financial management and detailed reporting, which can satisfy advanced users.

Ziggma is a fee-based service that charges its clients based on the amount of Ziggma help, the level of investment management and other circles needed. It offers individual financial planning and application of technology in wealth management.

Betterment has its management fees at 0.25% for its digital plan, while the premium plan stands at 0.40%. It provides different investment products and robo-advisory services.

Customer Support

Empower allows users to have access to credentialed financial advisors when the account balance is $100,000 or higher. They also provide customer support by phone and email.

Simplifi by Quicken does not offer live customer support services, however, it does offer a lot of online materials and easy to navigate software to assist its users with their financial status.

Quicken Classic Premier has several ways in which they can help customers, whether via phone, online, or by getting a professional financial advisor for the more complicated uses of the software.

Ziggma provides personalized financial advice and customer support through its platform, ensuring users have access to expert guidance when needed.

Betterment offers customer support through phone and email, with access to financial advisors for premium plan subscribers.

Security and Privacy

Security and privacy concerns are on Empower’s top list, boasting of encryption and security storage of user data. It also offers two-factor authentication as well as security checks to make sure client files are secure enough.

Subsequently, Simplifi by Quicken will not share the users’ data with third parties and is free from ads. It has encryption for users’ details and avails frequent security releases.

Quicken Classic Premier has inherent protection, such as data encryption, two-factor authentication, and timely updates to enhance user data safety.

Safety is given paramount importance on Ziggma, where nothing is done to compromise the customer’s privacy, information being encrypted and stored safely. It also takes care of the recurrent security updates and then two-factor authentication.

The data is also encrypted, and two-factor authentications and security audits are exercised from time to time at Betterment. This also enables it to meet the standard data protection and privacy requirements of the industry in which it operates.

Making the Right Choice

Here to help you make an informed decision, below are identified potential pitfalls, an assessment of your needs, and an overview of initial steps with the selected application.

Mistakes to Avoid When Choosing a Wealth Management App

The first wrong choice is choosing an app without fully comprehending its characteristics and how they will help or harm your money plans. For instance, Empower has exceptional investment tools for tracking and consulting, but if you just need a budget application, then Empower is not ideal.

Another general mistake made by most tenders is failure to consider the fee aspect. Betterment divides its fees through various tiers, and if not considered, it will affect investment returns.

Thus, the same thing can be said of usability and interface; if ignored, they can make users frustrated. For example, Quicken Classic Premier edition comes with full features, which makes it somewhat complex for using for a beginner.

Lastly, lack of consideration towards customer support quality can be an issue of concern. Simplifi by Quicken has a lot of website resources available to clients, but unfortunately, there is no option for speaking with a representative—something that may become necessary during a crisis.

How to Evaluate Your Needs and Match Them with the Right App

Start by defining your financial goals. If you’re looking for a comprehensive financial overview, Empower offers tools for tracking net worth, investments, and detailed budgeting.

For those focused on simplifying their spending plans and setting financial goals, Simplifi by Quicken provides an intuitive and easy-to-navigate platform. If you need advanced financial management tools, Quicken Classic Premier offers extensive customization and detailed reporting for investments and taxes.

Ziggma focuses on automated investment services and personalized financial advice, making it ideal for those who prefer hands-off investment management. For users interested in automated investing with a modern interface, Betterment provides personalized portfolios based on financial goals and risk tolerance.

Consider the cost and fee structure as well. Empower requires a higher account minimum for its advisory services, while Simplifi by Quicken and Quicken Classic Premier have subscription fees that can add up. Ziggma offers subscription-based services with varying fees depending on the level of service, while Betterment charges a management fee based on the plan you choose.

Lastly, customer support and available resources should be assessed. Empower provides access to financial advisors for high-net-worth accounts, while Simplifi by Quicken and Betterment offers extensive online resources. Quicken Classic Premier includes phone support and access to financial advisors, and Ziggma ensures personalized financial advice through its platform.

Tips for Getting Started with Your Chosen App

When you have identified the right wealth management tool, then beginning properly is as important as choosing the best wealth management app. Start with the application’s options and configurations list. For instance, Empower enables one to connect all the money management accounts in order to access a complete financial picture. Always avail yourself of any guide or tutorial offered by the app to fully learn what the app has to offer. If you haven’t created your categories and limits, Simplifi by Quicken has options for spending plans and goal tracking, which means this is the right place to start.

If you’re using Quicken Classic Premier, set up your accounts and explore its investment tracking tools. Use Ziggma’s automated planning tools to define your financial goals and investment strategies. For Betterment users, start by creating a personalized investment portfolio and setting your financial goals within the app.

If you are currently using Quicken Classic Premier, then follow the instructions below to set up your accounts and take a look at Quicken’s investment options. Employ the planning applications from Ziggma to set your fiscal objectives and investment plans. For Betterment users, log in to the app, create their own investment law, and define their financial objectives.

Make a habit of regularly reviewing your financial data and adjusting your strategies based on insights provided by the app. If you encounter any issues or have questions, don’t hesitate to reach out to customer support or consult online resources. Regularly updating and reviewing your information within the app will ensure that your financial planning remains aligned with your evolving goals and circumstances.

How Orient Software Can Help?

Choosing the right wealth management tool is crucial for effective financial planning and achieving your long-term financial goals. A well-designed app can simplify complex financial tasks, provide insightful analytics, and help you stay on track with your investments and savings. However, finding an app that perfectly fits your unique needs can be challenging.

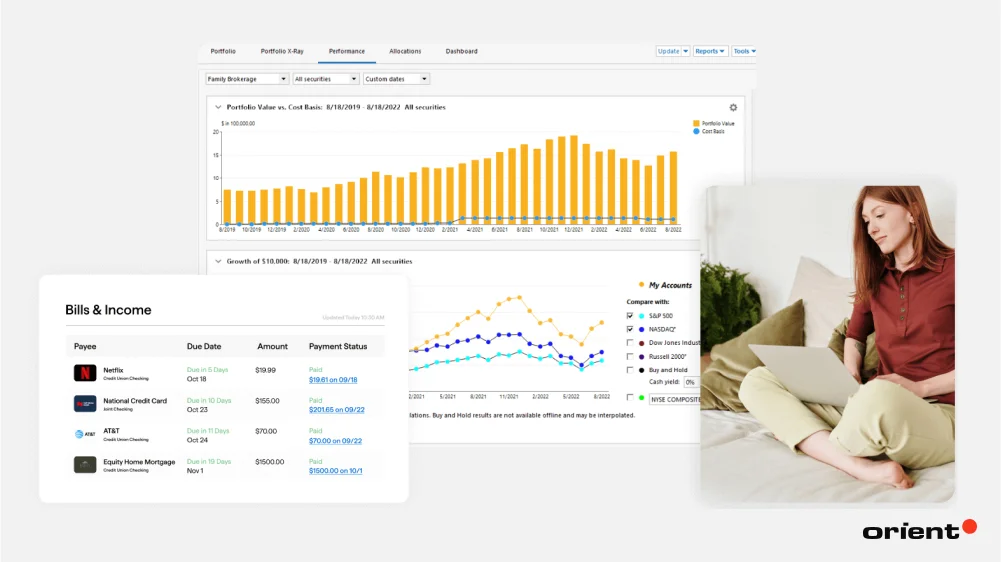

This is why Orient Software can be handy. Due to the practice of mobile application development, Orient Software will be able to provide business clients with customized wealth management applications that are necessary in accordance with the specified needs. Whether you are seeking integrated and flexible complex financial tools, intensive investment reportage, or individual financial consulting and relevant characteristics added up to the application, we offer a team of experienced developers and designers to embody all your ideas. Thus, by cooperating with Orient Software, you can be sure that your app will be reliable, meet all the user’s expectations, be safe, and have all the potential to meet the demands of current financial technologies.